New to Canada? Buy Your First Home in Ottawa.

You don't need a long credit history to buy a house. We specialize in mortgages for newcomers, permanent residents, and work permit holders settling in Canada.

Building Your Life in Ottawa

Moving to a new country is challenging enough without worrying about housing. The good news is that Canada welcomes investment from new residents.

Our New to Canada Mortgage specialists help you navigate the Canadian banking system. We work with lenders who accept international credit reports and alternative payment history so you can buy a home immediately upon arrival.

Start Your ApplicationWho We Help

Helping new families put down roots in the Ottawa community.

Permanent Residents

Landed recently? As a PR, you have access to the same mortgage rates as Canadian citizens, even with limited credit history.

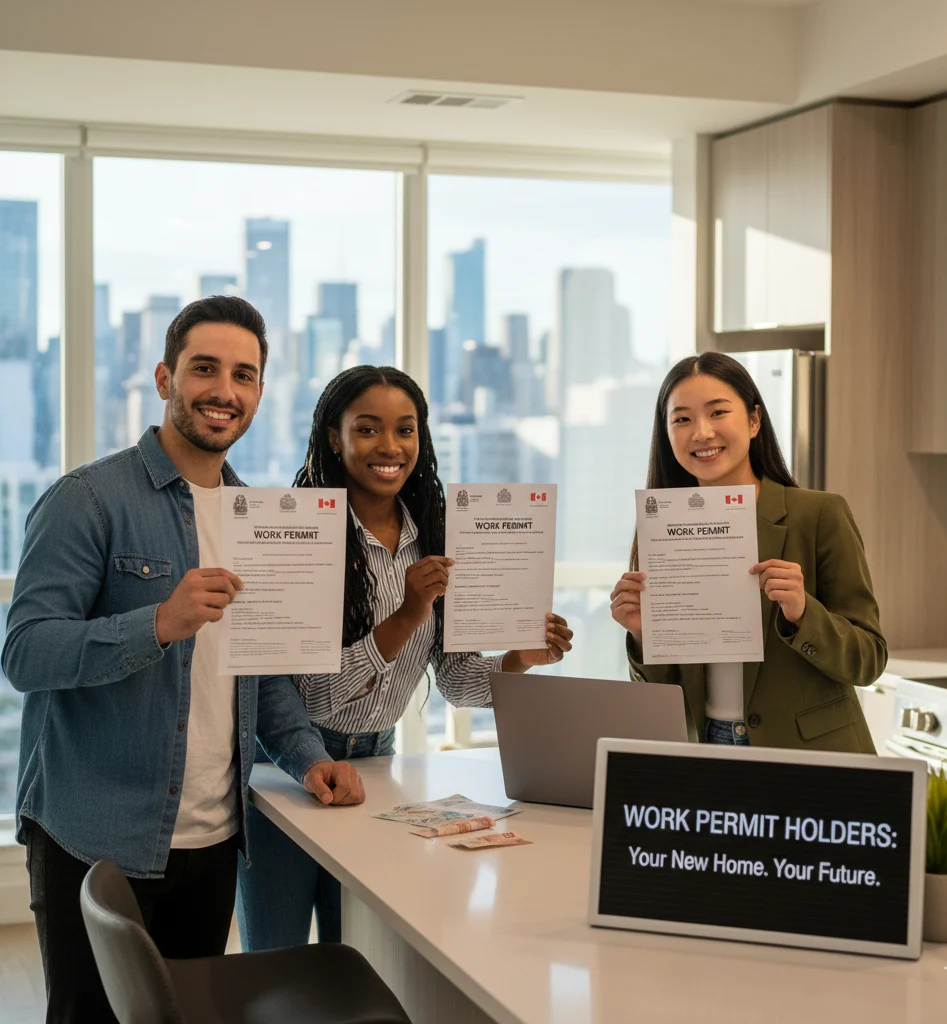

Work Permit Holders

Working in Ottawa's tech or government sectors? You can buy a home while on a valid work permit with as little as 5% down.

Returning Canadians

Lived abroad for years and coming back? Your credit gap doesn't have to be an issue. We help you re-establish your financial footprint.

What is the "New to Canada" Program?

Canadian mortgage insurers (like CMHC and Sagen) offer specific programs designed to help newcomers buy homes. These programs recognize that you may not have a Canadian credit score yet.

Instead of the traditional 2-year credit history requirement, lenders can approve your mortgage based on:

- International credit reports from your country of origin.

- 12 months of rental payment history in Canada.

- Proof of timely utility payments (hydro, internet, phone).

- A 12-month interest-only term to give you breathing room.

- Bank reference letters from your previous financial institution.

Whether you are settling in Kanata, Barrhaven, Orleans, or Downtown, we ensure your transition to homeownership is smooth and transparent.

Benefits of Buying Now

Don't wait years to build a credit score while house prices rise.

⚡ Stop Renting

Rental markets in Ottawa are expensive. Buying allows you to invest in your own future rather than paying a landlord.

🛡️ Build Credit Fast

A mortgage is the single best way to establish a strong Canadian credit score for your future financial needs.

🤝 Access "A" Rates

Newcomer programs allow you to access the best interest rates on the market, just like an established citizen.

📉 Low Down Payment

Qualify with as little as 5% down payment (for homes under $500k) or 10% down (for homes up to $1M).

🗓️ Expert Guidance

We explain every step of the Canadian buying process, closing costs, and legal requirements clearly.

🇨🇦 Local Networks

We connect you with newcomer-friendly realtors, lawyers, and inspectors in Ottawa.

How It Works

Your path to Canadian homeownership in 4 steps.

Status Review

We confirm your residency status (PR or Work Permit) and review your employment letter.

Alternative Credit

We gather alternative documents like 12 months of rent or utility bills to prove reliability.

Pre-Approval

We secure a mortgage pre-approval so you know exactly what you can afford in Ottawa.

Welcome Home

You make an offer, we finalize the funding, and you move into your new Canadian home.

Eligibility Requirements

Requirements for the New to Canada program.

- ✅ Must have immigrated or relocated to Canada within the last 5 years.

- ✅ Permanent Resident status OR a valid Work Permit.

- ✅ Full-time employment in Canada (no probation period preferred).

- ✅ Minimum 5% down payment from your own resources.

Frequently Asked Questions

Common questions from new residents.

Does the Foreign Buyer Ban affect me?

In many cases, no. Permanent Residents are exempt. Work Permit holders are also exempt if they have 183 days or more remaining on their permit and meet specific criteria. We can help verify your exemption.

Do I need a Canadian credit history?

No. If you don't have a Canadian credit score, we can use "alternative credit" sources like rent receipts, utility bills, or insurance payments to prove you are a reliable borrower.

How much down payment do I need?

If you have strong employment and alternative credit, you can buy with 5% down (on the first $500k). If you have no credit references at all, some lenders may ask for a larger down payment (20-35%).

Can I use money from my home country for the down payment?

Yes. You can transfer funds from abroad. However, the money must be in a Canadian bank account for at least 30-90 days before closing to comply with anti-money laundering laws.

Does my foreign income count?

Usually, lenders want to see Canadian income to ensure you can pay the mortgage here. However, if you work for an international company and were transferred to Ottawa, your tenure with the company counts.

What if I am self-employed?

If you recently started a business in Canada, it can be harder to qualify without 2 years of history. However, if you are doing the same work you did in your home country, we may be able to make an exception.

How long does the process take?

Once we have your documents (Work Permit/PR card, Job Letter, proof of down payment), we can usually get a pre-approval within 24 to 48 hours.

Start Your Canadian Dream Today.

We are honored to help you put down roots. Contact us to start your journey to homeownership in Ottawa.

⭐⭐⭐⭐⭐ "We moved to Ottawa 6 months ago and thought buying was impossible. You made it easy!" - The Chen Family